K9 Active: The Active Dog Wear Brand Leading the Pack with Lightspeed Retail

K9 Active is a premium dog apparel, health, and nutrition brand. Founded by Keith and Zena Conkey in 2008, K9 Active has spearheaded dogwear within the UK, seen 20% YoY growth for the last five years, moved into a new 2,500 square foot property, and plans to launch their own dog bakery and self-wash area. Read more to find out how.

Business Type:

Pet Store

Locations:

Dunfermline, UK

Paw-fecting Dog Wear. One Piece At a Time.

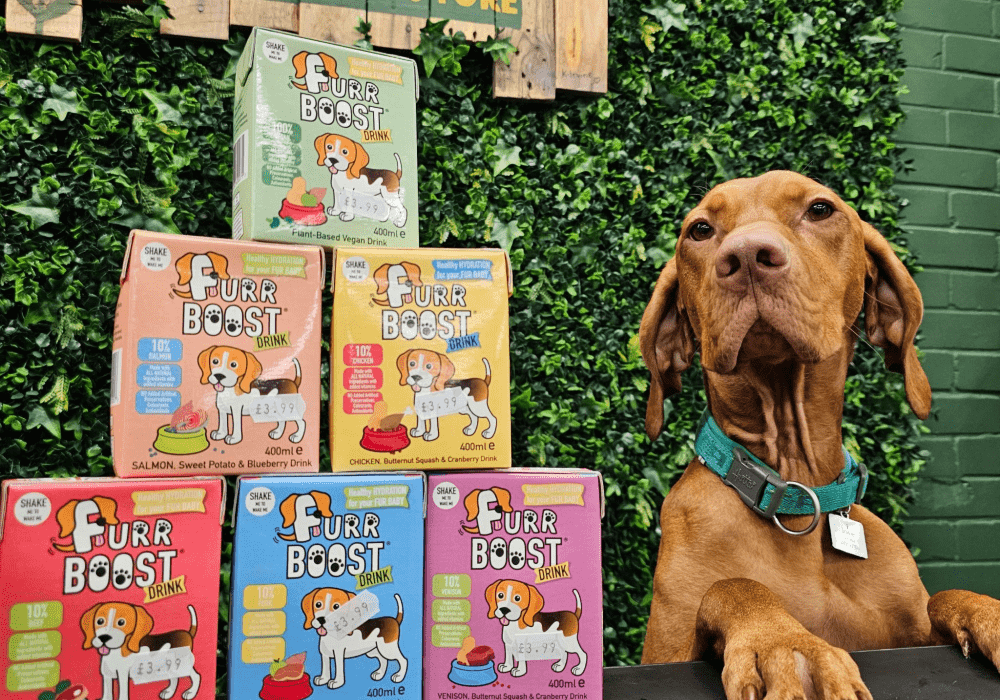

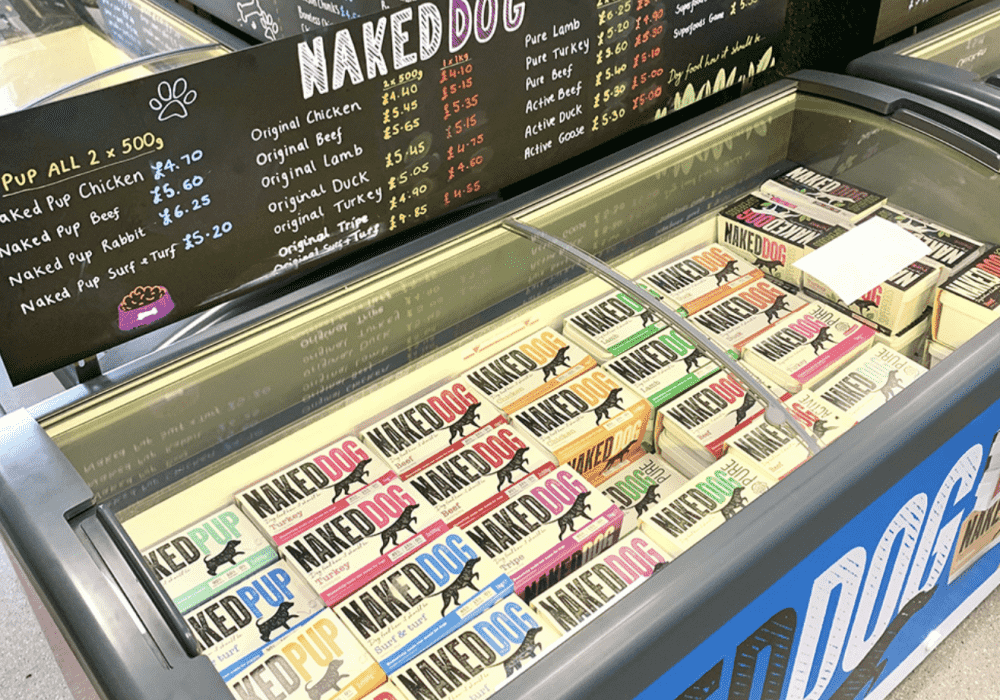

K9 Active believes dogs deserve more. That’s why they started in the first place. After numerous occasions of being asked by other dog walkers where they got their premium dogwear, Keith and Zena had a light-bulb moment and thought “Why don’t we just sell these ourselves?” Working from a little office in their home, Keith and Zena got to work. Nearly 16 years later, K9 Active is thriving due to one core principle: “We think of the dog first. We wouldn’t sell anything we wouldn’t give to our own dogs”, Keith said.

After expanding from online sales to opening their own physical store, K9 Active has since moved into a 2,500 square foot location, moved from exclusively selling apparel to nutrition and health, and even made a rather successful trip to Crufts in 2017, doing over one month's turnover in four days.

Lightspeed Retail. A Man’s Best Friend.

When Keith and Zena found Lightspeed, it wasn’t to manage their store, run stock control, or process their online orders. They use a system called Veeqo for that. What they needed was something that would easily integrate and communicate with Veeqo so they could seamlessly manage their stock in real-time across both their physical stores and online orders. “We needed something that would talk to Veeqo. And at that time, the only platform that did it was Lightspeed,” Keith said.

Uploading New Products? Done “Within Three Minutes.”

That’s not to say that Lightspeed hasn’t become an integral part of their business. Keith and Zena use Lightspeed primarily for adding new products to their stock. “Adding a product, compared to doing it on my website, is far easier. If we decide to buy a product, the delivery comes in and I can have a product on the system literally within three minutes, ready for sale. I love the speed at which I can add products,” Keith said.

“We've trained staff on the product, and it's so simple to explain and incredibly easy to use. The system makes taking sales quick and effortless, ideal when the store gets busy.” Keith continued.

Lightspeed Payments have helped streamline operations, too. “Our money’s in our account the next day compared to maybe 5 or 6 days later with other systems. Getting the funding quite quickly is great. When I do the end of day consolidation, I know what's going into my bank account the next day.”

Barking Up the Right Tree with Lightspeed Capital

Every year, Keith and Zena go to the Pet and Aquatics Trade Show (PAT’s) on the lookout for new stock items they can add to their shop and sell over the Christmas period. Normally, they’ve taken cash out of the business, or even considered bank loans, but last year, they opted for something different.

“We applied for Lightspeed Capital and took that money along”, Keith said. “We’ve considered normal bank loans in the past, but they’ve been a bit harder to get. Capital was just quicker and easier. You do it online and within a couple of days the funding is in your bank account. It's so easy to do it and get the acceptance. And, it's so easy to make the repayments, too. It didn't affect the cash flow of the business at all,” Keith continued.

“We got a reasonable amount of funding that allowed us to buy a bit more stock than we would normally have done. So, it allowed us to get better discounts. We have exciting plans for the future. We're considering adding a dog bakery and a self-wash area for dogs, both of which will require funding. Capital would be good for something like that.”

“You don't need to stress about repayments because they’re automatically deducted from your sales. We took out the funding during the busy Christmas period, which helped us pay it back faster. It's been a tremendous success. I’d highly recommend it. Absolutely 100%.”

‘We’ve considered normal bank loans in the past, but they’ve been a bit harder to get. Capital was just quicker and easier. You don't need to stress about repayments because they’re automatically deducted from your sales. It's been a tremendous success. I’d highly recommend it. Absolutely 100%. ’Keith Conkey, Founder, K9 Active