If you’re in the process of requesting quotes from different merchant services, you’ve probably come to realize that there are many different rates out there. You might also start feeling like hidden fees are just the name of the game.

After all, there’s a reason why many business owners say that there are 2 types of entrepreneurs: those who have been burned by a payments company, and those who have yet to be burned by a payments company. This is why we want to educate merchants about this rather complicated-for-nothing industry. Because when you break it down, it’s actually pretty straightforward.

After learning how the payment process works, the next step is to break down the cost and fee structure of a typical payment provider. Keep reading to learn about the different pricing models, the various hidden fees to look out for, how these fees affect your rate, and how you can reduce your overall cost to process payments for your business.

By the end of this guide, you’ll have an idea of how to get the cheapest credit card processing rate for your business.

- How exactly does a payment get processed?

- Pricing models

- Negotiable fees

- Hidden fees to watch for

- How to calculate effective rate and markup

- Operational changes that cut costs

Watch our resident expert, Michael, break payments down for you.

How exactly does a payment get processed?

Here’s what it takes to process a card payment, from the moment a card swipes at the POS until the payment lands in your bank account.

- The point of sale takes the credit card data and sends it off to another computer called a payment gateway. This device encrypts the credit card information to make it secure.

- The gateway then sends that data to a processing company. This company communicates with banks to make sure the credit card is active and valid.

- This confirmation is then sent back through the gateway to the point of sale, and the terminal tells the server that the payment has been approved.

- Once validated, the terminal generates a receipt for the transaction and puts it in that night’s batch.

- When the system batches out at the end of the night, the payment, along with all others in the batch, is sent back to the gateway, which encrypts all the credit card information again.

- Once encrypted, the gateway sends the data from that batch to the processing company, which executes all the transactions, transferring money to the business’ bank account.

Now that you’re familiar with how the process works on the backend, let’s review your options for pricing models and how to spot hidden fees.

Pricing models

The list of credit and debit card processing fees is long, but if you want to process cards in your store, you have no choice but to pay them. Some are negotiable, some are not, but it’s important to educate yourself on what these fees are, how much you’re being charged and why you’re paying them. If you don’t, how will you ever know if you were charged unfairly? Better yet, how will you ever determine what your true overhead is?

Let’s start from the beginning.

If you look back at the visual above, you’ll notice that every player that touches Sophie’s $100 purchase is getting paid.

- The business owner gets paid for that pair of shoes she’s buying

- The processor gets its processing fee

- The card brand gets its assessment fee

- The issuing bank gets its interchange fee

Who pays all those fees? Well, the merchant (i.e., you), of course. But payment processors won’t detail all that out when pitching their price to you, as that’s not appealing. They’ll add everything up and package it in an easier way for you to understand.

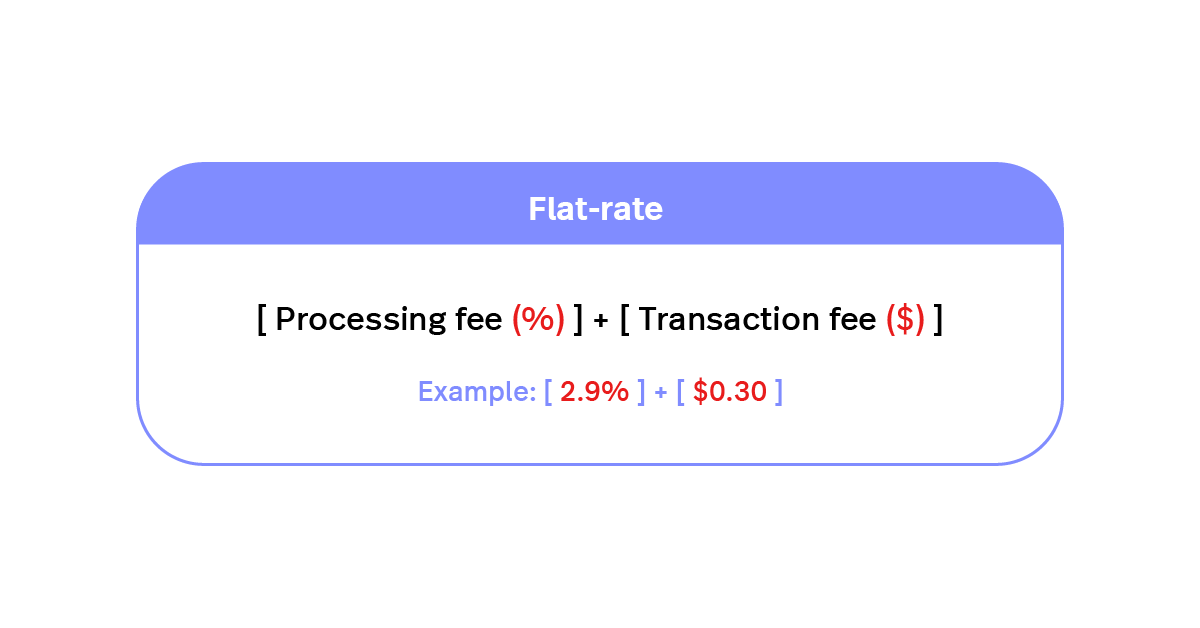

The most common way for payment processors to present their price looks like this: 2.9% + $0.30 per transaction and is referred to as flat-rate pricing.

Although that is typically the pricing model processors opt for, this isn’t the only way to package it. In fact, there are three different models you can expect:

1. Flat-rate

The most straightforward pricing method. You pay one flat rate per every transaction, no more, no less. The processing fee is a single, fixed percentage composed of what the processor, card brand and issuing bank charge. The transaction fee is a fixed amount determined by the processor and serves as a buffer.

What’s great about this method of pricing is that you always know what to expect once you receive your merchant statement, and it makes spotting anomalies a lot easier and systematic, should there be any.

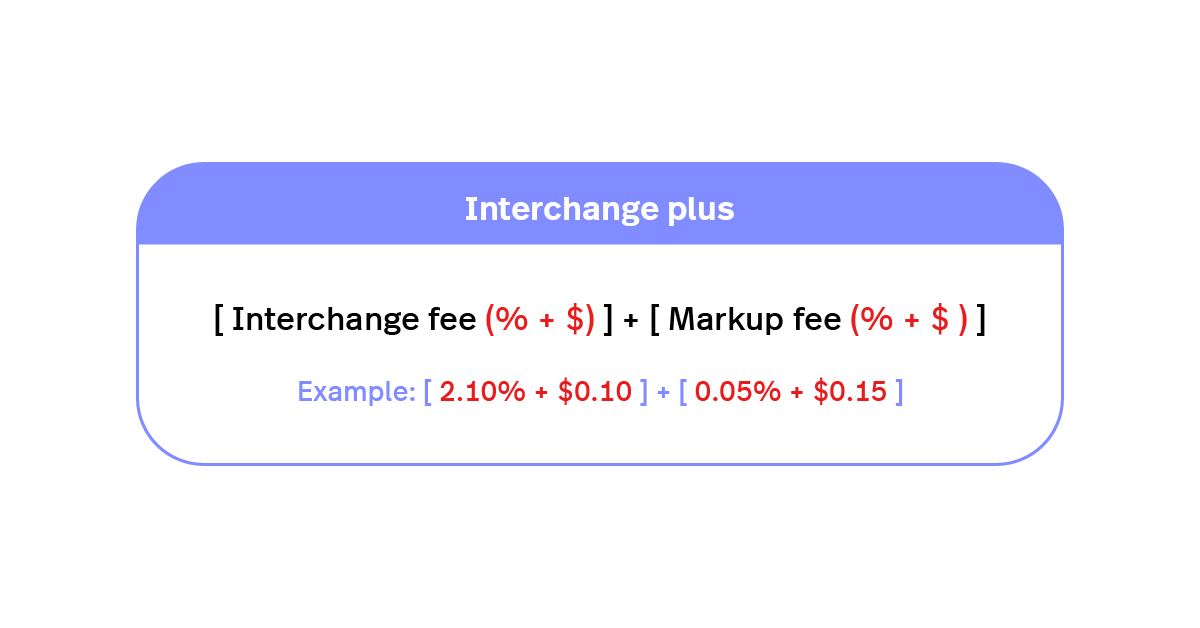

2. Interchange plus

This model is more difficult to understand because of all the variables that come into play when you process a transaction. Like:

- The total transaction amount

- The card brand

- The card type

- The issuing bank

- The processor

- The entry type (manual, swipe, type)

- What country the card is from

- If you batch out the same day or not

- Etc.

Every one of these components have an effect on the interchange fee. The markup fee, however, is determined by your processor, for which they have their own set of rules and varying factors.

Bottom line, every single one of the transactions you process is subject to a different rate. This makes it a lot harder for you to know what to expect once you receive your monthly statement, and verifying for mistakes also becomes a much longer process.

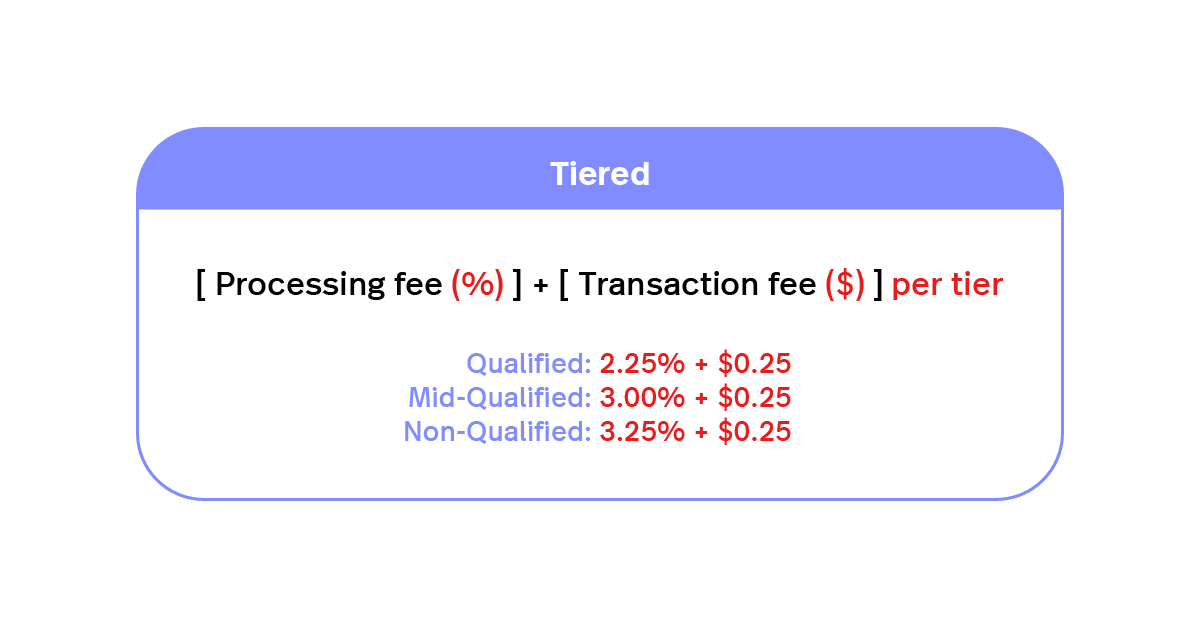

3. Tiered

The typical tiered pricing model will have 3 categories: qualified, mid-qualified, and non-qualified. Some processors go for 6 categories, but those are rather rare.

Tiered pricing is the least preferred of all the pricing models because it tends to be the most deceiving. It is composed of a fixed processing and transaction fee, just like the flat-rate. The big difference here is that transactions are categorized into tiers, and depending on which tier they fall under, the fixed rate will vary.

What’s deceiving about tiered pricing is that there’s no way for you to know beforehand what transactions fall into what tier. It’s all up to the processor, and they don’t disclose that information. The cheapest first tier pricing is what they’ll advertise and quote you on, but the majority of your transactions will be channeled through the mid or non-qualified tiers.

This model ends up being quite expensive and can lead to a lot of frustration once you get your statement. So be wary: if the price is too good to be true, it might be tiered pricing.

Our two cents

The breakdown of each model can be hard to remember when you’re on the phone with a payment processing representative. The easiest way to remember the logistics of each model is to compare it to something else that you already understand. Like mortgage rates.

- The flat-rate pricing is like getting a fixed mortgage rate.

Your contract locks you in at a fixed rate for a predetermined period of time. - The interchange plus pricing is just like getting a variable mortgage rate.

During the course of your contract, your rate will fluctuate depending on the “market”. - The tiered pricing is a combination of the 2.

Which isn’t technically a mortgage rate type, but you get it.

Negotiable fees

No matter the processor you choose, or the type of pricing model they offer, there is always room for negotiation. The interchange fee (payable to the issuing bank) and the assessment fee (payable to the card brand) are regulated by the card association, rendering them non-negotiable. These fees are imposed on the processor for every transaction, and thus relayed onto you to pay.

However, the processing fee (payable to your payment provider) is unregulated, and completely up to your processor’s discretion. This is where you can (and should) bargain.

Hidden fees

They’re called hidden fees for a reason: they’re buried in the fine print. So guess what? You have to read it. All of it. We can’t promise it’ll be a very interesting read, but in this case, you can’t afford not to. A lot could be hidden in there.

There are typically about 15 to 20 different common fees that could apply to your business, and depending on your contract and pricing model, they will vary.

- Monthly or Annual Fee – From $0 to $100 per month or $0 to $300 per year

- Terminal/Equipment Fee – From $5 to $60 per month

- PCI non-compliance Fee – From $20 to $120 per year

- Chargeback Fee – From $10 to $30 per occurrence

- Monthly Minimum Fee – From $0 to $25 per month

- Cancelation or Early Termination Fee (ETF) – From $300 to $1000 per occurrence

- Address Verification System (AVS) Fee – From $0.05 to $0.25 per occurrence

- Batch Fee – From $0.05 to $0.30 per occurrence

- Application/Setup Fee – From $50 to $100 per occurrence

- PIN Debit Transaction Fee – From $50 to $60 per year

- Payment Gateway Fee – From $5 to $25 per month

- Online Reporting Fee – From $0 to $10 per month

- Account Closure Fee – From $20 to $75 per occurrence

- Merchant Location Fee – From $5 to 15$ per year

- IRS Reporting Fee – 25$ per year

- Statement Fee – From $5 to $10 per month

- Voice Authorization Fee (VAF) – From $0.25 to $4 per occurrence

- Non-Sufficient Funds Fee (NSF) – From $20 to $25 per occurrence

These are the most common ones, but there are more. If at any point you find something in your preliminary contract that you don’t understand, never hesitate to ask your payment sales rep to get to the bottom of all your possible charges. Now is the time before you get locked in.

Not only are you ensuring you get the best possible price now, but you’re also making it a lot easier and faster for yourself to pinpoint unethical billing (should it ever happen) once that monthly statement comes in.

Knowledge is power.

How to calculate effective rate and markup

Your effective rate is the total percentage of your sales lost to fees. It’s easy to calculate: divide total monthly fees such as statement fees, gateway fees, equipment leases and more by the sum of total monthly sales.

Your effective markup compares processors that offer interchange-plus or subscription plans.

If your monthly sales total is $10,000 and you pay $650 in markup fees (including statement fees and additional monthly services), your effective markup calculation is simply:

(markup fee/total sale) x 100

= (650/10,000) x 100

= (0.065) x 100

= 6.5 percent

This doesn’t work for comparing tiered or pay-as-you-go processors, who don’t separate markup from the interchange. But it is a basic credit card processing fee calculation that will be enough to get you started.

Operational changes that cut costs

Besides negotiating with your processor and keeping an eye out for hidden fees, there are changes to the way you run your business that can help reduce processing costs.

Optimize transaction types

Regardless of your processor or merchant services provider, you’re going to pay more for certain transaction types. For example:

- Swiped transactions usually cost less than keyed-in transactions

- Debit typically costs less than credit

- EMV typically costs less than swiped transactions

As a merchant, you can’t control what payment methods your customers prefer or have in their wallet on any given day. However, it’s not uncommon for merchants to incentivize or ask their customers to pay with a specific method. For example, when pumping gas, you might see a lower price for cash vs. credit.

Pricing products differently based on payment method is a somewhat dubious tactic, but there are ways that you can steer your customers in the direction you want. For example, clear signage or a friendly word from a cashier can make it clear you would prefer that shoppers pay with a particular method.

Similarly, ensuring that you have the right payments hardware can help here also. EMV almost always has a lower interchange rate than a swiped card. However, you can’t run EMV transactions if you don’t have an EMV capable reader, so ensuring you have the right payments hardware is the best first step to take with this initiative.

Lastly, you’ll want to avoid keying in transactions whenever possible. Not only do these transactions typically feature the highest interchange rate, but they expose you to increased instances of fraud and the burden of paying a chargeback. Keying in a card number circumvents many of the security and authorization processes built into credit cards, which is why fraudsters prefer paying this way with stolen cards.

Opt for integrated payments

Ensure your credit card processor tightly integrates with your point of sale system. Doing so ensures that payment data flows seamlessly from your POS to your payments terminal, thus reducing the need to key in transaction data.

Integrated payments make checkout easier and limit human error. And while these aren’t technically lowering your payment processing fees, they can lead to time (and money) savings for your business.

To implement integrated payments, start by connecting with your POS provider. At Lightspeed, for instance, we offer unified payments so you can process credit card transactions without leaving your POS.

In addition to benefiting from transparent and flat-rate pricing, using Lightspeed Payments means that all your POS and payments needs are taken care of under one roof.

There’s no need to juggle multiple vendors, which leads to more streamlined operations.

Settle transactions as soon as possible

Another operational tip that can help you lower your credit card processing rate is to settle transactions as quickly as possible. It’s common for many small businesses to do this after close of business. But after a long shift, it can be easy to put this off to the next day or two. However, businesses can typically expect to get the best interchange rate if they settle charges within 24 hours. Because of that, this tip is particularly important if you use an interchange plus processor.

Every business is different

Lightspeed is a point of sale with integrated payments, so we can help you find payment solutions for your business that save you money and time. Let’s chat.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.